Unlocked: The Best 30 Year Mortgage Rates Today and How to Secure Them

When it comes to purchasing a home, one of the most significant expenses is the mortgage. A 30-year mortgage is a popular choice among homebuyers, offering a fixed interest rate and a long repayment period. However, the current state of 30-year mortgage rates can significantly impact your financial situation. In this article, we will explore the current 30-year mortgage rates, the best rates available, and provide a step-by-step guide on how to apply for a mortgage.

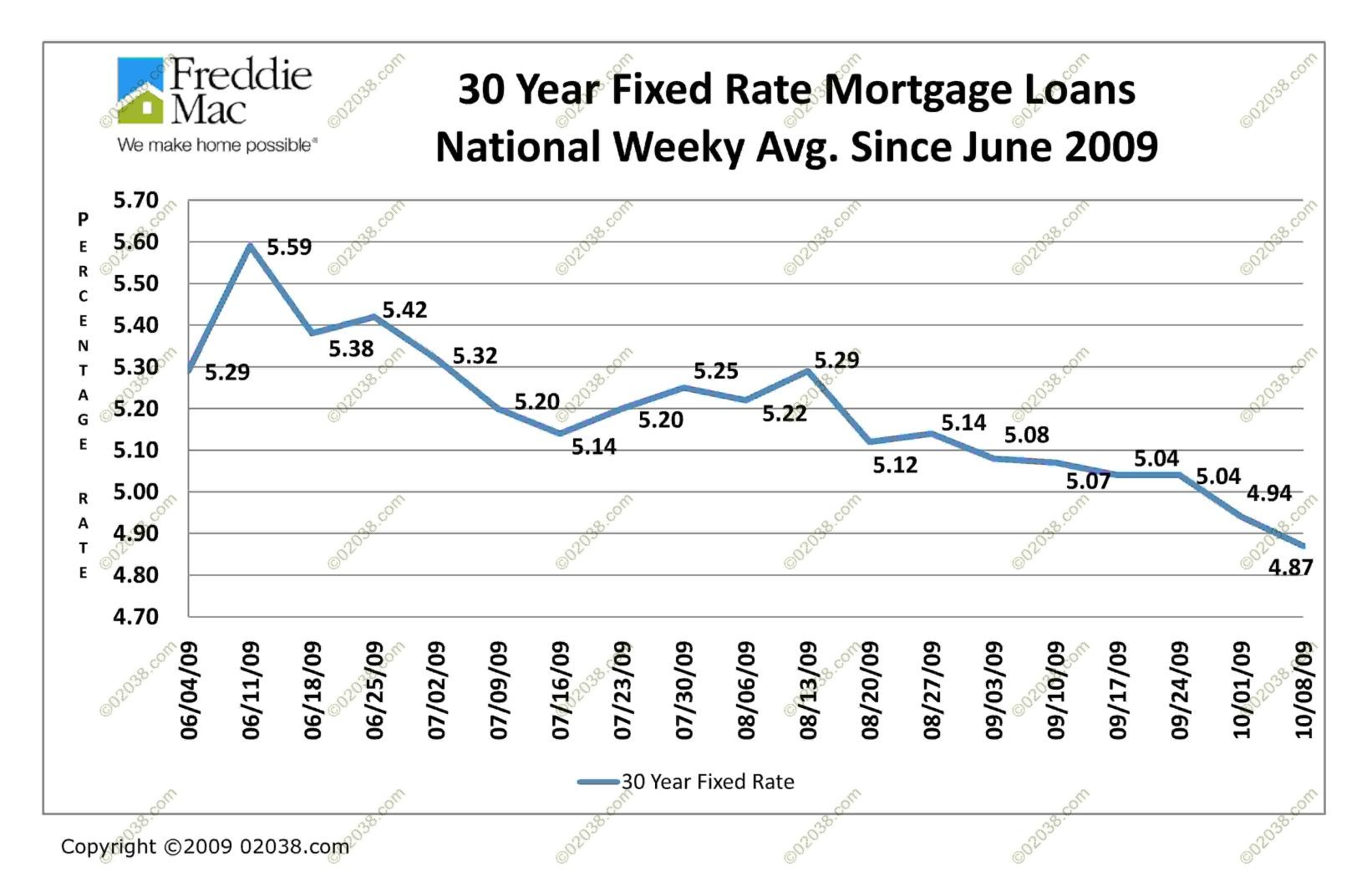

The current state of the housing market has led to fluctuations in mortgage rates. As of [current date], the average 30-year fixed mortgage rate is at [current rate], making it an attractive option for homebuyers. However, it's essential to note that mortgage rates can change rapidly, and it's crucial to stay informed about the latest rates.

Understanding 30 Year Mortgage Rates

A 30-year mortgage is a type of fixed-rate mortgage that offers a stable interest rate for the life of the loan. The interest rate is fixed, meaning it remains the same throughout the entire term of the loan. This type of mortgage is popular among homebuyers because it provides predictable monthly payments and a longer repayment period.

Here are some key features of 30-year mortgages:

- Fixed interest rate: The interest rate remains the same throughout the life of the loan

- Long repayment period: 30 years, providing a stable monthly payment

- Predictable payments: Your monthly payment remains the same throughout the loan term

- Lower monthly payments: Compared to shorter loan terms, such as 15-year mortgages

The Best 30 Year Mortgage Rates Today

The best 30-year mortgage rates vary depending on several factors, including your credit score, loan amount, and property type. As of [current date], some of the best 30-year mortgage rates are:

- 3.75% - 4.00% for good credit (720+)

- 4.00% - 4.25% for fair credit (660-719)

- 4.25% - 4.50% for poor credit (620-659)

- 4.50% - 5.00% for bad credit (580-619)

Keep in mind that these rates are subject to change and may not reflect the actual rate you qualify for.

Factors Affecting 30 Year Mortgage Rates

Several factors can impact your 30-year mortgage rate, including:

- Credit score: A good credit score can lead to lower interest rates

- Loan amount: Larger loan amounts may result in higher interest rates

- Property type: Different types of properties, such as single-family homes or condos, may have varying interest rates

- Loan term: Shorter loan terms, such as 15-year mortgages, may have lower interest rates

How to Apply for a 30 Year Mortgage

Applying for a 30-year mortgage is a relatively straightforward process. Here's a step-by-step guide to get you started:

Step 1: Check Your Credit Score

Your credit score plays a significant role in determining your interest rate. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame.

Step 2: Research Lenders

Compare rates and terms from multiple lenders, including banks, credit unions, and online mortgage providers. Some popular lenders include:

- Wells Fargo

- Chase

- Bank of America

- Quicken Loans

- SoFi

Step 3: Pre-Qualify

Contact a lender and provide basic information, such as your income, employment history, and credit score. The lender will provide a pre-qualification letter stating the amount you're eligible to borrow.

Step 4: Apply for Pre-Approval

Once you've pre-qualified, you can apply for pre-approval. This involves providing additional documentation, such as pay stubs and tax returns. The lender will review your application and provide a pre-approval letter stating the loan amount and interest rate.

Step 5: Shop Around

Compare rates and terms from multiple lenders to find the best deal. Consider working with a mortgage broker, who can shop around on your behalf.

Step 6: Finalize Your Application

Once you've selected a lender and interest rate, you'll need to finalize your application. This involves providing additional documentation, such as appraisals and title reports.

Step 7: Close the Deal

The final step is to close the deal. This involves signing the loan documents and transferring the ownership of the property.

Common Mistakes to Avoid

Avoid common mistakes, such as:

- Not checking your credit score before applying

- Not shopping around for the best rates and terms

- Not carefully reviewing loan documents

- Not considering additional costs, such as closing costs and mortgage insurance

By following these steps and avoiding common mistakes, you can secure the best 30-year mortgage rate today.

Additional Resources

For more information on 30-year mortgage rates and the homebuying process, consider the following resources:

- Federal Reserve Economic Data (FRED)

- National Association of Realtors (NAR)

- Consumer Financial Protection Bureau (CFPB)

By staying informed and taking the time to research, you can make an informed decision about your 30-year mortgage and secure the best rate available.

Is Annaawai Married

Cinemas 2021

Billytranger Things

Article Recommendations

- Whenid Piddyie

- Lara Diabla

- Kay Flock

- Maligoshik

- Madi Ruve

- Lyra Crow Fans

- Diddy Meek Mill Audio

- Megyn Kelly Children

- Is Willmith Alive

- Camilla Araujo Fansd